california competes tax credit carryforward

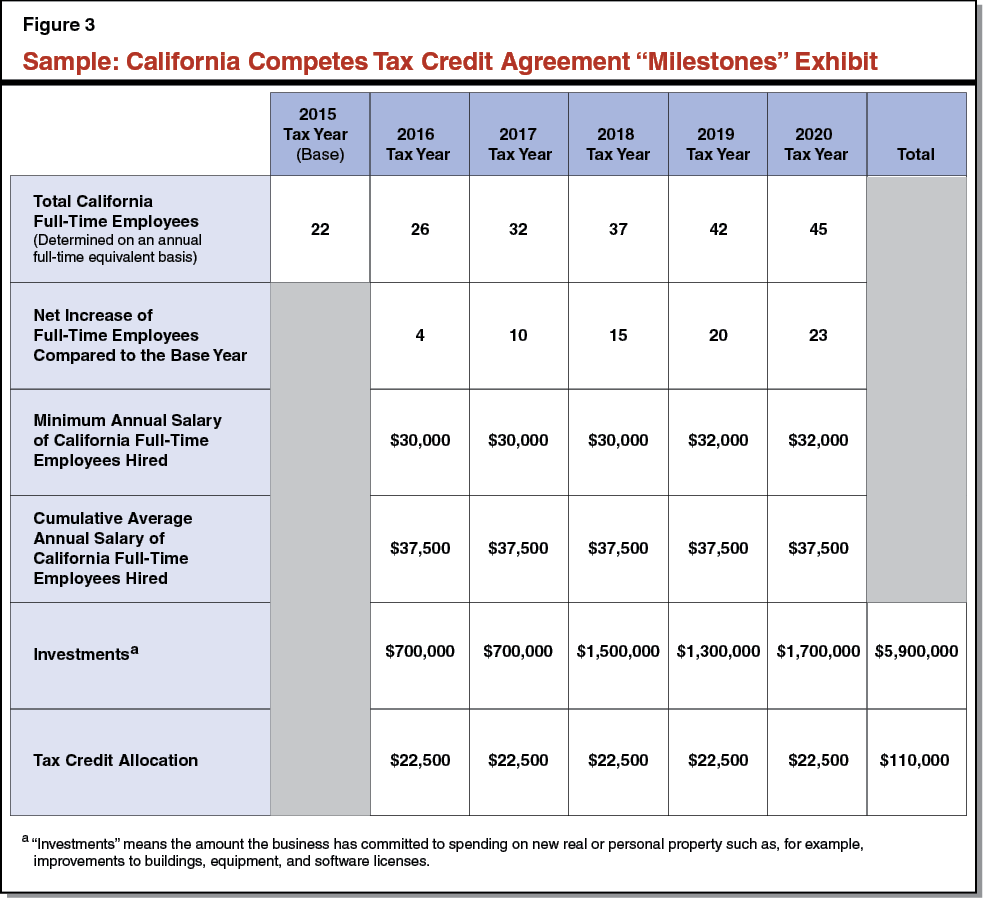

California Competes Credit Report March 2016. Number of jobs created or retained Compensation paid to employees Amount of investment Duration of.

California Competes Tax Credit Kbkg Tax Solutions

California Competes Tax Credit Continued Credit awards are based on 12 factors.

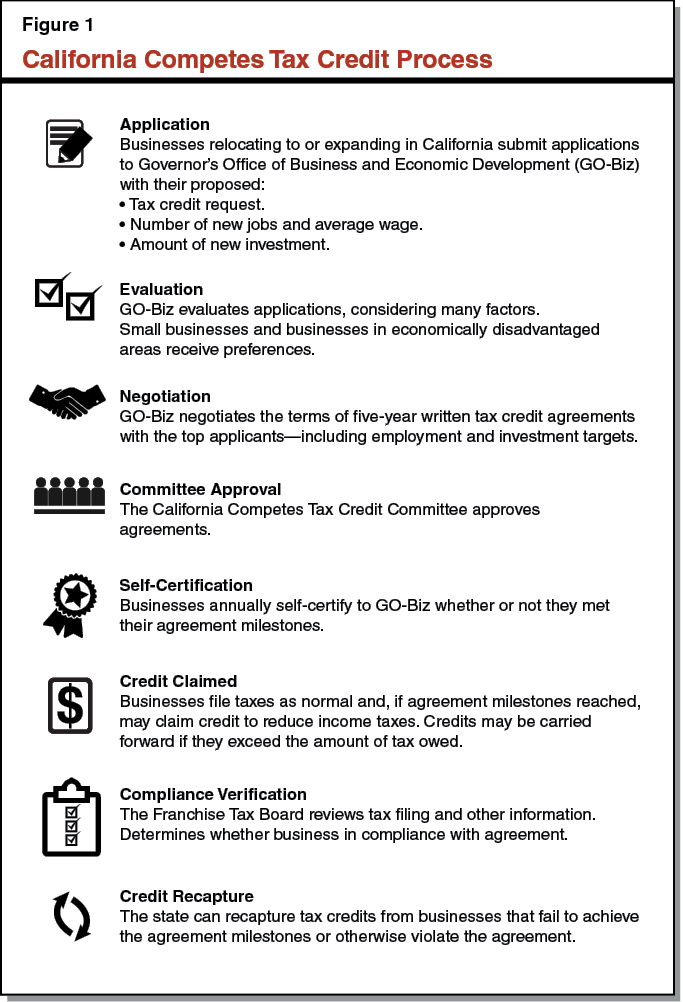

. The California Competes Tax Credit is administered by the Governors Office of Business and Economic Development GO-Biz. It is a non-refundable income tax credit with a. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

For the first application period 150 million is available for allocation. You can download or print current or past-year. We last updated the California Competes Tax Credit in February 2022 so this is the latest version of Form 3531 fully updated for tax year 2021.

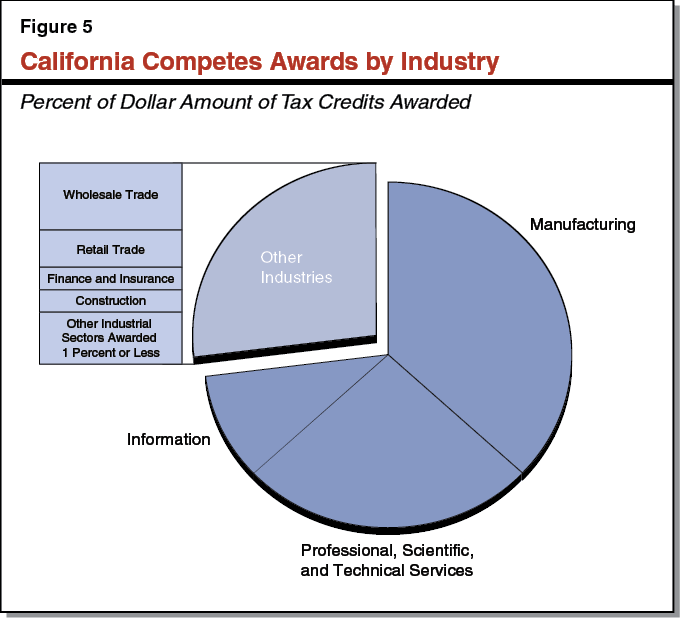

916 322-4051 10 Governors Office of usiness Economic. California Competes Tax Credit Apply. Businesses of any industry size or location compete for over 231 million available in tax credits by applying in one of the three application periods each year.

780 million for 5 years of credits - 30 million 201314. 180 million in each fiscal year 2018-19 through 2022-23. How much in tax credits will be available each year.

The tentative amount of credits that can be allocated by GO-Biz is as follows. Give it a Try. The California Competes Tax Credit.

On Any Device OS. Creative Packaging Company Which Will Do Business in California as. Applications for the credit will be accepted at calcompetescagov from July 26 2021 until August 16 2021.

If a taxpayer does not have sufficient tax liability in a year with a credit installment there is a six-year carryforward period to utilize the credit. Total Tax Credit Awards. This mandated report was prepared by the Franchise Tax Board FTB to disclose the total annual amount of credits claimed under the.

200 million 2015-16 2016-17 2017-18. Value of the Individual Credit.

Site Selection Overview Of The Types Of Incentives

Review Of The California Competes Tax Credit

California Competes Tax Credit Relocation Credit Los Angeles Cpa

California Competes Tax Credit Relocation Credit Los Angeles Cpa

California Tax Incentive S Success Is In Its Failures 1

State Tax Credit And Incentives Update Marcum Llp Accountants And Advisors

California Budget Includes Nol Suspension Tax Credit Limits

Solved Question 19 The Child And Dependent Care Expenses Tax Chegg Com

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

Review Of The California Competes Tax Credit

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Tax Season 2020 New Challenges And California S Response

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Funding California Competes Tax Credit And Creation Of The California Competes Grant Program Holthouse Carlin Van Trigt Llp

Last Chance To Apply For Tax Credits And Grants For Your Business Eastern Sierra Now

What Is The R D Tax Credit Who Qualifies Estimate The Credit

Review Of The California Competes Tax Credit

Application Window For California Competes Program Opens July 25 Pwc

Temporary California Net Operating Loss Suspension Signed Into Law Kbf Cpas